Merchant Cash Advance Calculator

Use the calculator provided below to estimate your repayments for a merchant cash advance (MCA)

Want to understand the cost of your loan?

Use the calculator provided below to estimate your repayments for a merchant cash advance (MCA)

Calculations are indicative only and intended as a guide only. The figures calculated are not a statement of the actual repayments that will be charged on any actual loan and do not constitute a loan offer.

Daily average repayment

£0

Approximate repayment in days

Total repayment of the loan

£0

If you are satisfied with your results, you can proceed here

Merchant Cash Advance Calculator

Small and medium-sized enterprises (SMEs) often face financial challenges that can hinder their growth and operations. One innovative solution to these challenges is the Merchant Cash Advance (MCA). An MCA provides businesses with quick access to capital, repaid through a percentage of future credit card sales. To help business owners understand and manage their MCAs, a Merchant Cash Advance Calculator becomes an invaluable tool. This guide will look into the workings of an MCA calculator, its benefits, and how to use it effectively.

What is a Merchant Cash Advance Calculator?

A Merchant Cash Advance Calculator is an online tool designed to help business owners estimate the cost and repayment schedule of an MCA. By inputting various parameters, the calculator provides an estimate of the total repayment amount, the daily or weekly repayment amount, and the duration of the repayment period.

Benefits of Using an MCA Calculator

1. Budgeting and Planning: By knowing the approximate repayment amounts, businesses can plan their cash flow more effectively.

2. Comparison Shopping: Business owners can use the calculator to compare different MCA offers and help to choose the one that best suits their financial needs.

3. Time-Saving: Quickly obtain estimates without the need to engage in lengthy discussions with multiple MCA providers.

How to Use a Merchant Cash Advance Calculator

Using an MCA calculator is straightforward. Here’s a step-by-step guide:

1. Input the amount you’d like to borrow through the MCA

2. Provide the factor rate offered by the MCA provider.

3. Input your average card sales per month

4. Input the percentage repayment on credit card sales

5. Click the calculate button to receive an estimate of the total repayment amount, daily or weekly repayment amounts, and the repayment period.

Example Calculation

Let’s walk through an example to illustrate how an MCA calculator works.

• Advance Amount: £50,000

• Factor Rate: 1.3

• Repayment on future card sales: 10%

Using these inputs, the calculator will provide the following estimates:

• Total Repayment Amount: £65,000 (£50,000 * 1.3)

• Daily Repayment Amount: If the business generates £50,000 in credit card sales daily, the daily repayment would be £167 (£50,000 * 10%).

• Repayment Period: The repayment period will depend on the daily credit card sales. In this example, it would take approximately 389 days to repay the MCA (£65,000 / £167)

Factors Affecting MCA Costs

Several factors can influence the cost and repayment of an MCA:

1. Sales Volume: Higher daily credit card sales can shorten the repayment period.

2. Seasonality: Businesses with seasonal fluctuations in sales might experience variations in their repayment amounts.

3. Factor Rate: A higher factor rate increases the total repayment amount.

4. Holdback Percentage: A higher holdback percentage increases daily repayments but can reduce the overall repayment period.

Advantages of Merchant Cash Advances

1. Quick Access to Funds: MCAs provide rapid funding, often within a few days, which is crucial for businesses needing immediate capital.

2. Flexible Repayment: Repayments fluctuate with sales, easing the burden during slow periods.

3. No Collateral Required: MCAs are unsecured, meaning businesses don’t need to pledge assets as collateral.

4. Credit Score Irrelevant: MCA approval is based on sales history rather than credit scores, making it accessible to businesses with poor credit.

Disadvantages of Merchant Cash Advances

1. High Costs: The factor rates and fees associated with MCAs can make them expensive compared to traditional loans.

2. Impact on Cash Flow: Daily or weekly deductions can strain cash flow, especially during low sales periods.

3. Lack of Regulation: The MCA industry is less regulated than traditional lending, leading to potential risks and unfavourable terms.

A Merchant Cash Advance Calculator is a powerful tool for business owners seeking to understand and manage the costs associated with MCAs. By providing clear estimates of repayment amounts and periods, the calculator helps businesses make informed financial decisions. While MCAs offer quick and flexible funding insights, it’s crucial for businesses to carefully evaluate the terms and potential impact on their cash flow. Using an MCA calculator can aid in this evaluation, ensuring that businesses choose the most suitable financing option for their needs.

In conclusion, leveraging an MCA calculator can provide transparency and assist in strategic financial planning, ultimately contributing to the sustainable growth and success of the business.

Please note that the information above is not intended to be financial advice. You should seek independent financial advice before making any decisions about your financial future.

Calculations are indicative only and intended as a guide only. The figures calculated are not a statement of the actual repayments that will be charged on any actual loan. Tide will not be responsible for any discrepancy in the loan calculations and does not accept any liability for loss, which may be attributable to the reliance on and use of this calculator.

It’s important to remember that all loans and credit agreements come with risks. These risks include non-payment and late-payment of the agreed repayment plan, which could affect your business credit score and impact your ability to find future funding. Always read the terms and conditions of every loan or credit agreement before you proceed. Contact us for support if you ever face difficulties making your repayments.

Funding Options, now part of Tide, helps UK firms access business finance, working directly with businesses and their trusted advisors. Funding Options are a credit broker and do not provide loans directly. All finance and quotes are subject to status and income. Applicants must be aged 18 and over and terms and conditions apply. Guarantees and Indemnities may be required. Funding Options can introduce applicants to a number of providers based on the applicants' circumstances and creditworthiness. Funding Options will receive a commission or finder’s fee for effecting such finance introductions.

We're here to help

Find the right Funding Options without affecting your credit score by filling out our quick and easy form.

How does it work?

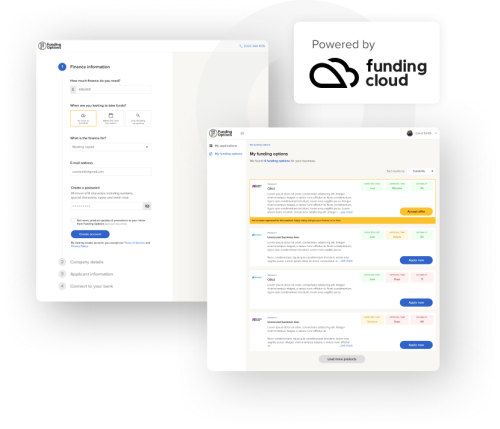

We break down funding barriers with a simple application process that empowers you. Our technology, Funding Cloud, accurately validates your business profile, matching you to the industry’s largest lender network. Funding results are uniquely tailored to each and every business.

Tell us how much you need

Tell us how much you need to borrow, what it's for and provide some basic information about your business.

Get an instant comparison

Our smart technology will compare up to 120+ lenders and match you with the right finance options for your needs.

Apply and get your funding

We'll help you through the process from application to receiving your funds.