Education

How to calculate business loan interest

26 Feb 2021

By working out what your business loan interest payments will be, you’ll be making a more informed decision about whether you have the cash flow required to support your debt. Use our business loan calculator to figure out how much you’ll owe on top of the principal amount.

Business loans can provide SMEs with the lifeline they need to stay operational, or the funds required to set ambitious growth plans into action. However, when working out if a business loan is affordable, you must also factor in interest payments and fees.

What is the business loan interest rate?

The interest rate on your loan is a percentage of the loan balance. You pay it to the lender on top of the original loan, which is called the ‘capital’ or ‘principal’. Your loan’s interest rate is the main cost associated with borrowing cash, but not the only one.

Additional costs can include:

Arrangement fees

Set-up fees

Early repayment fees

Insurance premiums

Why would anyone be okay with paying interest?

Of course, it’d be great not to have to pay interest, but it’s up to you to decide whether it’s worth it in the end. For instance, the business loan interest you pay might be significantly less than the extra revenue you’re set to make through additional sales after borrowing the funds.

Regardless of whether taking out a loan leads to a revenue boost or not, the money must still be repaid according to the terms of the loan. That’s why calculating the total cost of the loan is so important. Also, bear in mind that the interest you pay is a deductible expense.

To work out the cost of a loan, you need to factor in:

The principal loan amount

The loan’s term (the duration over which it’ll be paid back with interest)

The interest rate percentage

CALCULATE BUSINESS LOAN INTEREST

Here’s an example.

Imagine you run a cafe and demand is starting to pick up. To meet this increase in demand, you need to invest in more stock. However, you don’t currently have the cash flow to be able to facilitate this. So, you decide to take out a business loan of £2,000. The annual interest rate is 6% and your length of term is 12 months.

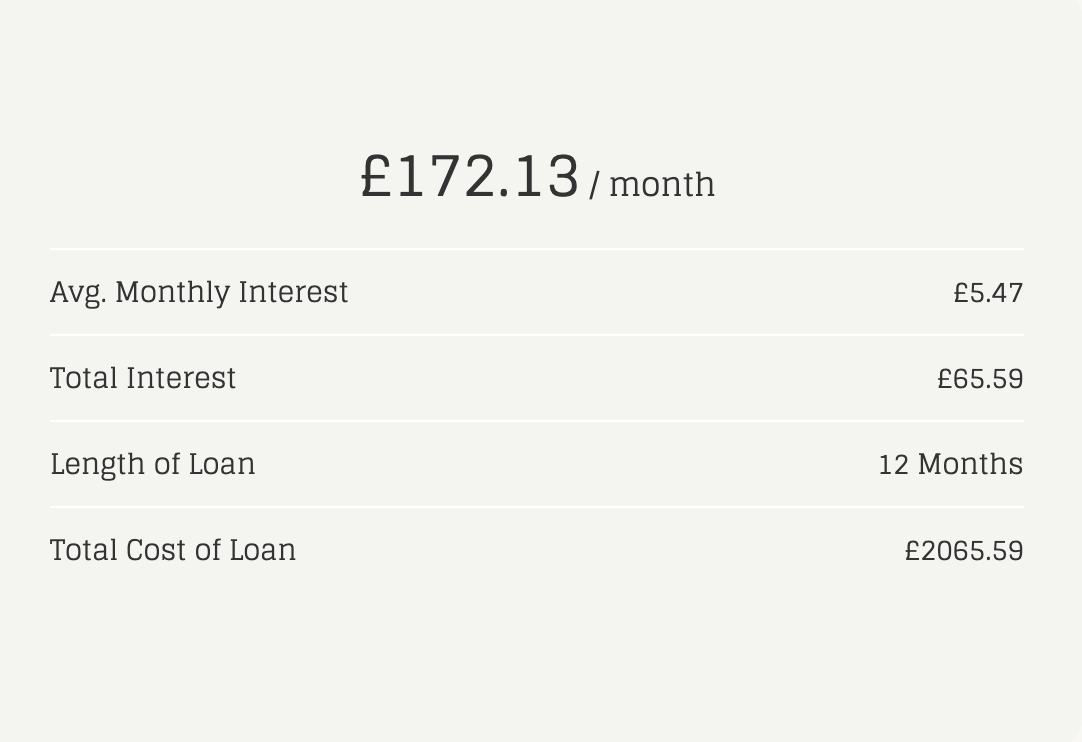

The average amount of monthly interest you’ll pay is £5.47, totalling £65.59 after the 12 months. The overall cost of the loan (without factoring in any additional fees) is £2065.59.

an example of business loan interest

How much can I borrow?

The maximum amount of you can borrow in business finance will vary depending on the lender, product and multiple factors relating to your business, including:

Your turnover and profit

Your credit history – business and personal

The length of the loan

Business affordability

You might be able to negotiate a more favourable interest rate by offering the lender security on the loan (some loans require security by default anyway). When offering a property or machinery as security, bear in mind that you may lose it if you default on the loan.

If you’re taking out asset finance to buy a vehicle or machinery, the asset itself may act as the loan security.

For those who simply don’t own assets and would rather not offer a personal guarantee, there are lots of unsecured options out there – take a look at merchant cash advances, for example. Unlike a traditional term loan, you pay the principal amount plus interest back through customer card payments.

Additional fees and APR

As well as the interest rate, you might have to pay additional fees at the lender’s discretion such as an arrangement fee. You may be expected to pay this fee, if applicable, on the loan application. Or it could be added to the loan as part of the overall cost.

Bear in mind that fees increase the cost of the loan, therefore you should tag them on to your calculation.

Let’s say you borrow £2,000 and pay £200 interest on your loan, plus a £100 arrangement fee. In this instance you’ll pay back a total of £2,300. Y2our total finance cost is £300, which is the equivalent of an ‘annual percentage rate’ (APR) of 15%.

The APR represents the total cost of the borrowing, including fees as well as interest. That’s why it’s important to look at the APR when researching business finance options.

There are a growing number of alternative business loan and lender options out there designed to help SMEs like yours access the finance they need to thrive. At the same time, the amount of choice can make the decision-making process lengthier and more complex.

That’s where Funding Options comes in.

We combine innovative technology with our years of expertise to find you the right business loan for your needs. We’ll ensure you get the best deal, explain the details – including interest rates – transparently, and support you through the application process. Find a finance solution that fits today.

Get startedBusiness Finance

Check your eligibility using our online form without affecting your credit score.

Apply nowSubscribe to our newsletter today

Sign up for the best of Funding Options sent straight to your inbox.