Bank Referral Scheme

Your bank couldn’t help you get the finance you need? Don’t worry, we’re here to help you find an alternative.

Choose your bank to get started.

How does it work?

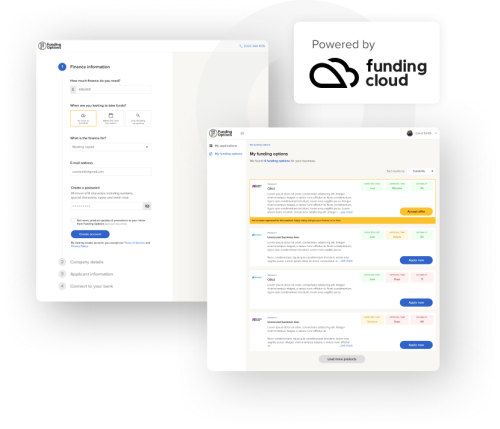

We break down funding barriers with a simple application process that empowers you. Our technology, Funding Cloud, accurately validates your business profile, matching you to the industry’s largest lender network. Funding results are uniquely tailored to each and every business.

Tell us how much you need

Tell us how much you need to borrow, what it's for and provide some basic information about your business.

Get an instant comparison

Our smart technology will compare up to 120+ lenders and match you with the right finance options for your needs.

Apply and get your funding

We'll help you through the process from application to receiving your funds.

Frequently Asked Questions

What is Funding Options by Tide?

Funding Options is the UK’s leading business finance marketplace, helping business owners like you all over the UK. Whether you need cash flow or would like to grow your business, we’ll help you find the right finance for your situation. It might be to settle a tax bill, pay your staff early for Christmas, or cover an unexpected shortfall — valid, normal, parts of running a business.

Funding Options has been chosen by the government-owned British Business Bank to be one of the designated finance platforms for the Bank Referral Scheme — which means banks are required by law to offer their unsuccessful applications a referral to us. We then help these businesses find finance from our robust lending panel.

Why use Funding Options?

Our aim is to find the right finance for your business, even if it didn’t work out with your bank.

We believe in you: whether you want to ‘hurry up and grow’ or you’re fighting for survival, we’ll help you find the right finance for your situation.

We're in this together: we’ll be right there with you through the whole process, from the first enquiry to money in the bank and beyond.

We give it to you straight: with no jargon and no “BS”. If it looks like a dog and walks like a dog, we’ve got a name for it — a dog.

Our customers rate us as “Excellent” on independent review site Trustpilot.

We believe in Treating Customers Fairly, and we’re authorised and regulated by the Financial Conduct Authority (Reference Number 727867).

What is the Bank Referral Scheme?

The Bank Referral Scheme helps businesses who’ve been unsuccessful with the major banks find finance elsewhere.

The Government passed a law* in 2015 which requires banks to offer to refer their unsuccessful applicants to designated finance platforms. These platforms will then help the referred business find another source of business finance. Funding Options is one of these Government-designated finance platforms.

How it works:

If you’re unsuccessful with the bank (which might mean they don’t offer you enough or you don’t like their terms), they have to offer you a referral to a government designated finance platform like us.

You don’t have to accept a referral — it’s completely up to you — and there’s no obligation to take any of your options or offers if you do accept a referral.

Once you’re referred to us, we’ll ask a few simple questions about your business like how much money you need and what it’s for. Then we’ll match you with the lenders most suitable for your situation and requirements, and if you like what you see, we’ll help you through the application process with them.

My bank couldn't help – can Funding Options?

At Funding Options our mission is to help all businesses get the finance deal that’s right for them. Many of our customers couldn’t get finance through their bank, but secure a deal with another provider by using our service.

Unfortunately, some businesses find it’s just not the right time to borrow money — and although we work with dozens of the UK’s leading lenders, sometimes there are no options available for businesses in particular situations.

The following are common issues that can mean there aren’t any lenders available to help:

Short trading history (less than 2 years)

Insufficient assets

Low turnover/making a loss

Pre-existing debt

Legal action such as CCJs and winding up orders

Every business is different — if you're not sure, the fastest way to see whether you could be eligible for business finance is to start an application with Funding Options. It only takes a couple of minutes to see your options, and it's completely free and no-obligation.

Is non-bank finance more expensive?

Yes, non-bank finance is often more expensive — but not always.

Through Funding Options, you can access dozens of the UK’s best lenders, and we’ll always find the lender that suits your requirements best. If cost is an important factor for you, let us know and we’ll do everything we can to get you the best deal.

If you’re unsure, or you just want some indicative quotes, get in touch with our team of Business Finance Specialists and they’ll be happy to help — it’s completely free and no-obligation.

How long will it take to get finance?

Our fastest case was completed in 1 ½ hours, from initial enquiry to funds in the business's bank account. Our record from enquiry to approval is just 7 minutes.

In our experience, the biggest factor in how quickly you’ll get finance is you. Most lenders will reply quickly (within 24 hours), and your dedicated account manager will work hard to keep things moving. If you’ve got all the documentation ready, it’s often possible to get the deal done within a day or two.

First, you’ll need to give us the key details about your business and what you’re looking for. This will only take a few minutes, and you can do it on our website or give us a call.

Once you’ve decided which lender(s) you’d like us to approach, the application time varies depending on the product and lender you’re dealing with – but it always helps if you’ve prepared in advance!

Lenders we work with are much faster than the banks

Takes seconds to see your options

Offers back within 24–48 hours for most cases

Money in account within days if you’ve got documents ready

What products are available?

Types of commercial finance available include bank term loans, invoice finance, hire purchase, equipment leasing, commercial mortgages, property development finance, peer-to-peer lending, revenue loans, and online short-term lenders, as well as government-backed start-up loans and not-for-profit social lenders.

Funding Options does not support equity funding.

Will you do a credit check?

Signing up on our website, seeing your funding options, and talking to one of our Business Finance Specialists won’t have an effect on your credit score. We, Funding Options, do not credit check you. However, many of the lenders we work with require a credit check as a normal part of their application process. For this reason, we may ask for your ‘permission to search’ to pass on to a lender in order to speed up your application and make the process as straightforward for you as possible.

You will never be credit checked by a lender we work with unless you have given your explicit consent. Personal credit checks are highly regulated, and you have rights as an individual for your personal data to be protected.

If you have any questions about credit checks and permission to search in relation to your finance enquiry, one of our team will be happy to discuss it further with you.

Will you recommend a product?

No, we cannot recommend products and we don’t give financial advice. Our service is all about finding the funding options that your business is eligible for, and matching them with your requirements and requests. We can give you information on each of your options, explain how they work, and clarify exactly what you’d be agreeing to; but you have to make the decision.

How do you make money?

Using our service is completely free and no-obligation, and we don't charge our customers a fee. You can use our matching tool, look at your options, or speak to one of our Business Finance Specialists with no strings attached. If you decide to go ahead, and a lender accepts your application for finance, they pay us a commission based on our standard terms. Normally, the cost to our customers is the same as if they’d gone direct to the lender.

We’re happy to disclose further commission details on request – if there’s anything else you’d like to know, feel free to get in touch.