Advisory

Recovery and reform: The post Covid-19 lending landscape webinar

Created on 28 May 2021

Updated on 27 May 2021

On the 27 May 2021, our Head of Sales Ryan Hyde-Smith and Head of Advisory Thomas Boyd hosted a webinar in partnership with the IFA to discuss the post Covid-19 recovery and the reform to the lending landscape.

Our joint webinar with the IFA, Recovery and reform: The post Covid-19 lending landscape is now available on-demand here.

As a recap, the webinar covered:

1. How Funding Options can help your clients grow

In 2020, cashflow related requests accounted for 38% of all enquiries, with funding requirements from businesses shifting from survival to growth. Throughout the last year, impacted sectors have required funding at each wave of restrictions being eased.

2. How the lending market has transformed over the last year

Covid-19 and the resulting national lockdown created panic among SMEs and business owners which resulted in unprecedented levels of demand for finance back in March 2020. As a result, Funding Options recorded a c.200% increase in cumulative loan amount requests from 2019 to 2020. Throughout 2020, funding purpose evolved from survival (Q2 20) to opportunity (Q3 & Q4 20) to survival (Q1 21) to reopening and recovery (Q2 21).

Government support schemes have changed customer expectations, with businesses now much more rate conscious and less supportive of personal guarantees. The various government loan schemes (CBILS, CLBILS and BBLS) restored liquidity into the lending market with BBLS injecting £47bn into the economy and CBILS injecting £24bn.

3. Recovery Loan Scheme

The Recovery Loan Scheme launched on 6 April 2021, at the beginning of the new financial year. It replaced the BBLS, CBILS and CLBILS to ensure businesses can continue to access the finance they need to recover and grow following the lockdown. The RLS is set to finish on 31 December 2021, subject to review.

Businesses of any size can apply for up to £10M in finance (or £30M for groups with subsidiaries). RLS finance can be used for any business purpose, including to boost cash flow and fund growth plans during the next phase of the country’s economic recovery.

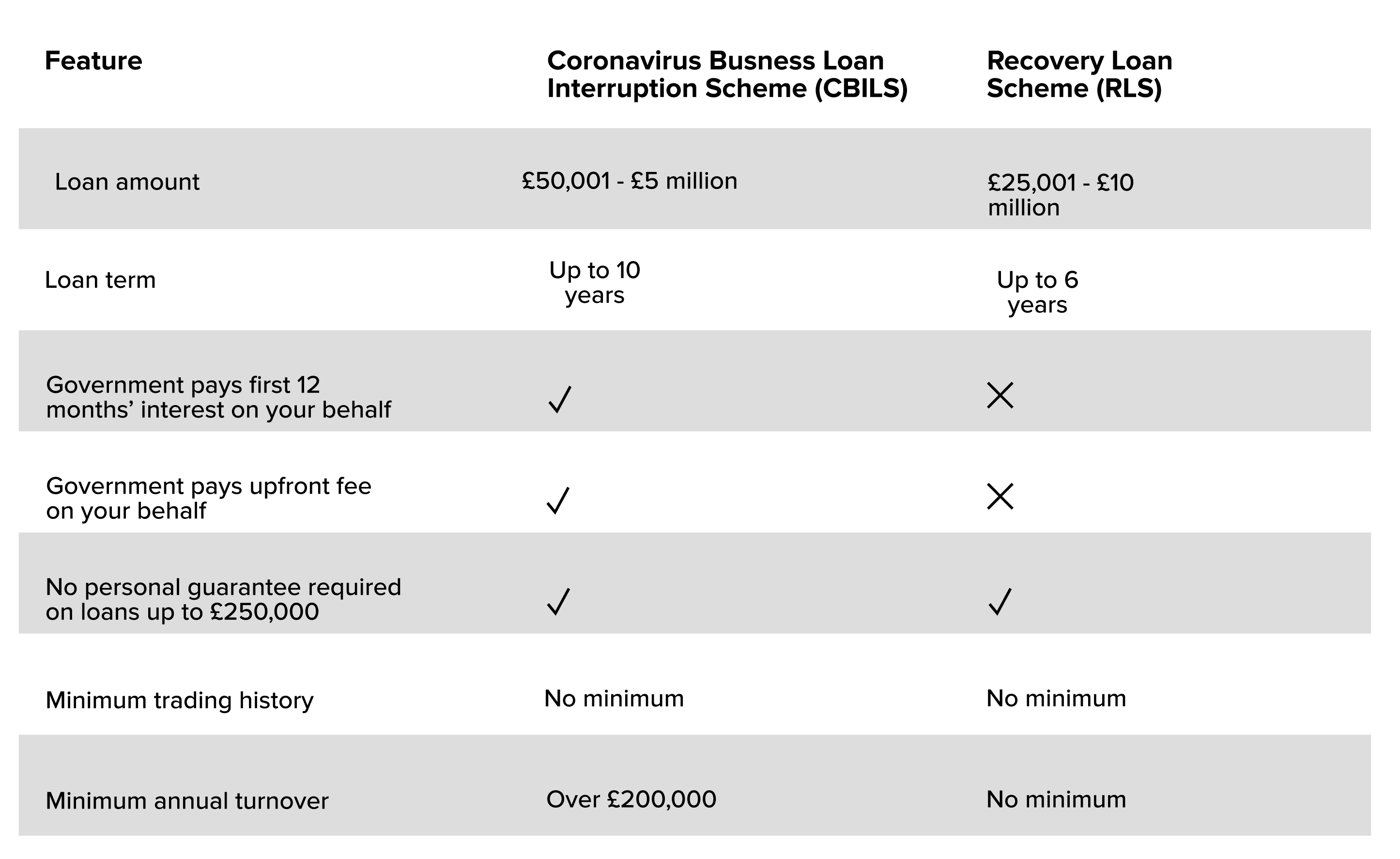

How does the RLS compare to the CBILS?

As the table below illustrates, the two schemes share some similarities. For example, no personal guarantees are required for facilities under £250,000. There are some clear differences too: the Government covered some of the costs of the CBILS, while the RLS is designed for a wider range of businesses and the loan amount available is higher.

CBILS vs. RLS Comparison Table

Term length: Term loans and asset finance facilities are available for up to six years; overdrafts and invoice finance are available for up to three years.

Value: The maximum value of each type of facility is £10m (£30m per group). Minimum facility sizes start at £1,000 for asset and invoice finance, and £25,001 for term loans and overdrafts.

Accessibility: No minimum/maximum trading history or annual turnover is required.

Personal guarantees: No personal guarantees on loan amounts under £250,000.

Liability: Businesses remain 100% liable for the debt and must meet all interest payments and fees associated with their RLS facility.

CBILS borrowers: The RLS is open to those who’ve borrowed from any of the previous schemes. However, the amount they borrowed under another scheme might affect how much they’re eligible for.

4. Structured Finance

Here at Funding Options, we have recently formed a Structured Finance team that specialise in structured and corporate finance requirements. We have a curated panel of 15+ lenders issuing finance from £500k to £20M.

Our Structured Finance lending panel provide debt, equity and royalty products with tailored options for M&A, MBO, MBI, LBO, growth capital and debt restructuring.

5. What it means to be an Advisory Partner

Create added value for your clients - By working with Funding Options to offer capital advisory as an additional service line. We’ll do the bulk of the work for you, allowing you to offer this extra service to your clients hassle-free.

Stay in tune with the ever-changing funding market - Become the go-to source for the market trends your clients’ need. We can keep you up-to-date with market movements, which you can pass onto your clients.

Watch your practice grow hand in hand with your valued clients - By assisting your clients to access the funding they need, you can create a stronger relationship with larger firms who need additional advice and services. This could range from growth planning or advice around tax, relocation, payroll, acquisitions, etc.

Ensure you are staying ahead of technological advancements - Our tech-driven platform allows your clients to instantly access our panel of 120+ lenders through one simple online application form. Using our technology allows you to unlock new opportunities for both you and your clients.

Stay on top of all your clients funding applications - Our new advisory portal allows you to submit, track and manage any ongoing applications for your clients.

Access to your own dedicated Business Finance Specialist - The world of business finance can be complex and confusing. Partnering with Funding Options means there will always someone on hand to assist with any queries you or your clients may have.

You can find it here if you missed the webinar or want to watch it in full again. Alternatively, reach out to our Advisory team if you have any questions about becoming an Advisory partner with us.

Join usSubscribe to our newsletter today

Sign up for the best of Funding Options sent straight to your inbox.